Contents

Diagram and benefits of a family limited partnership.

Purpose

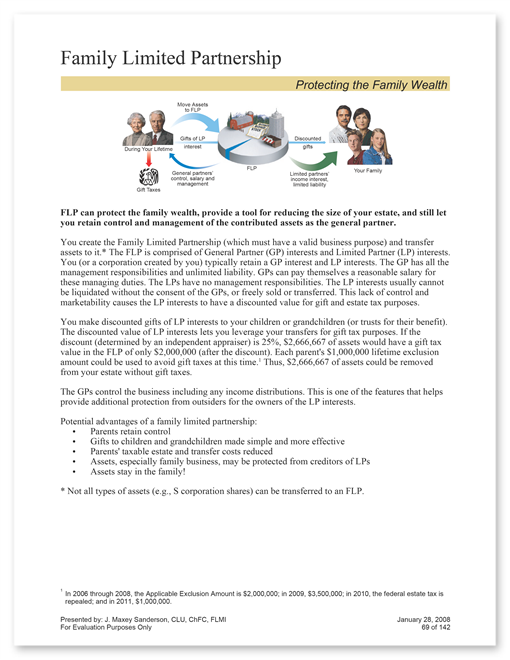

Shows how an FLP works. Assets are put into the FLP. A small portion is retained, but with it all managing rights (general partnership). The large portion just shares in the earnings, if management distributes any. Large portion used to give to other family members.

Uses

Can shift income and taxes to other family members and maintain control of the assets within the FLP.

Sales

Heirs can use income from the FLP to buy life insurance on general partners, outside estate and available for settlement costs.

Transitional Uses

Interest in the FLP can be used for a number of estate planning techniques, so it is important to understand how and why the FLP was created.

Appeal

Owners of family businesses and real estate seek both the protection offered by the FLP form of business, but also the ability to maintain control while reducing estate costs.